If a customer has paid in advance, paid more than they owe or you have issued a credit note, their credit will be reported as a credit (negative) balance in the Accounts receivable account.

Customer credit balances will be automatically applied to their next invoice.

If the next invoice is unlikely to be issued very soon or the customer has requested the credit be refunded, paying them will reduce their credit balance. For example, if the payment was from a cash account:

Go to Cash accounts tab.

Click on Balance amount under the cash account from which you will refund the customer.

Record new transaction by clicking on Spend money button.

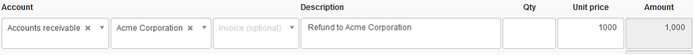

Select account Accounts Receivable, then select the customer and enter the amount paid to the customer.

1

1

Save the transaction by clicking the Create button.

Follow similar steps if the customer was refunded by another person and the refund is recorded under expense claims.