Suspense is a built-in account where MYBOS posts transactions it cannot properly resolve. Suspense has several unique characteristics:

| • | It can neither be created nor deleted by a user. |

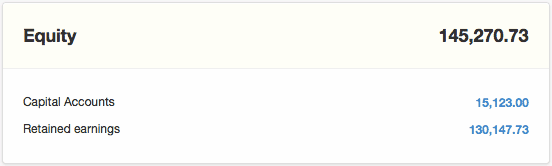

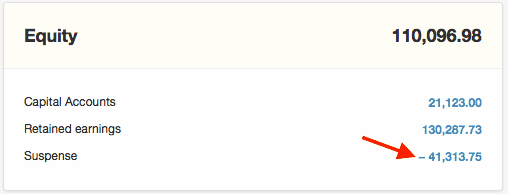

| • | It appears automatically on the Balance Sheet in the Equity grouping whenever it has a non-zero balance. |

| • | It it not listed in the Chart of Accounts under Settings, so it cannot be edited or moved to a different account group. |

| • | Many transaction fields in MYBOS default to Suspense until valid entries are made in them. |

Any balance in Suspense signals a problem. Never attempt to clear the Suspense account with a journal entry. That only hides problems and usually makes both your Balance Sheet and Profit and Loss Statement inaccurate. Problems that caused transactions to post to Suspense must be identified and corrected.

Finding problems in Suspense

To identify transactions with problems, first drill down by clicking on the blue balance for the Suspense account on the Summary page:

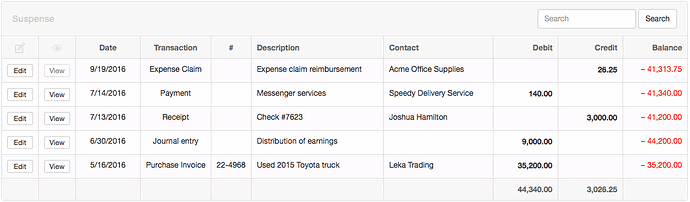

All transactions contributing to the balance will appear. Note these can be either debits or credits:

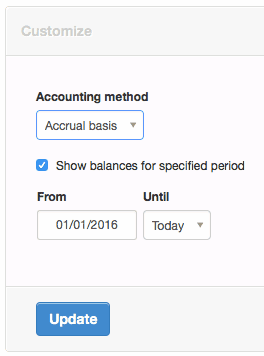

If the Edit button for any transaction is dimmed, be sure MYBOS is set for accrual basis accounting. Return to the Summary page and click Set Period:

Select Accrual basis in the dropdown box and click Update:

Then drill down again on the Suspense balance.

Fixing problems in Suspense

The Suspense account above reveals five transactions with some type of error. Each problem must be addressed individually. To fix one, click on the Edit button to the left of the transaction.

Example 1: Unassigned expense claim

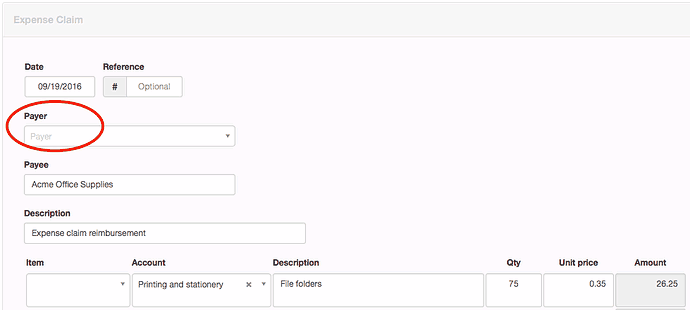

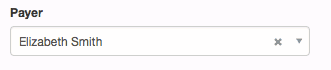

Beginning with the most recent transaction in the example, an expense claim did not include a Payer:

Designating a Payer from predefined choices clears this transaction from Suspense:

Remember to click the Update button to save each correction:

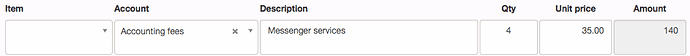

Example 2: Cash payment not complete

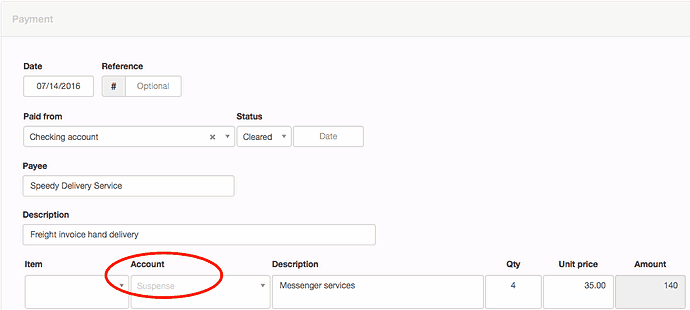

A cash payment for messenger services recorded the recipient, a description and number of deliveries, and price, but did not include proper allocation to an expense account:

Selection of the appropriate account correctly completes the transaction:

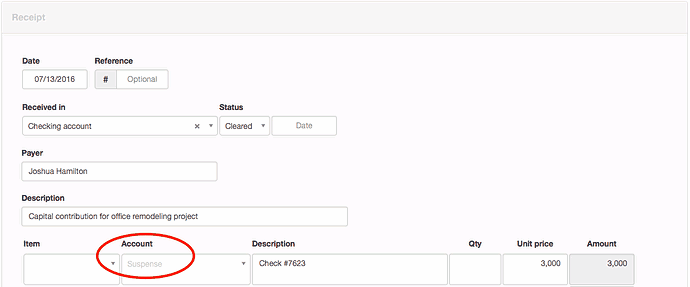

Example 3: Capital contribution not properly allocated

The next transaction recorded a contribution of capital from a partner to fund a remodeling project, but neglected to designate that the receipt was directed to a capital account, which partner's account, or which subaccount:

Adding those details to the receipt fixes the problem:

![]()

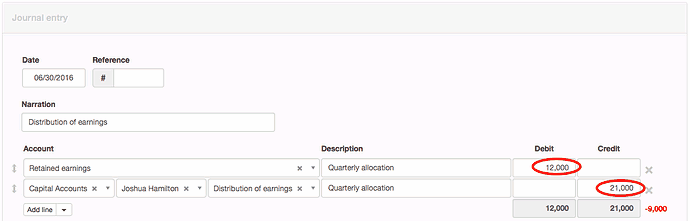

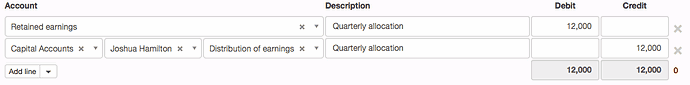

Example 4: Unbalanced journal entry

A journal entry contained a typographical error, reversing digits when recording a distribution of earnings. This mistake resulted in an unbalanced transaction:

Editing the mistake properly balances the transaction, removing it from Suspense:

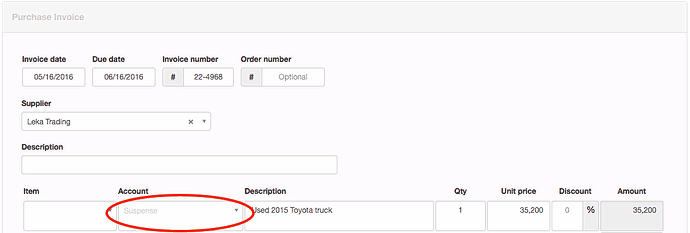

Example 5: Fixed asset purchase invoice

The final problem in the example was a purchase invoice for a delivery truck that did not properly assign the purchase to the Fixed assets account and the specific asset created for the truck:

The corrected purchase invoice resolves the problem:

![]()

Suspense is now empty and no longer shows on the Balance Sheet: