Multi-component custom tax codes present several accounting challenges. Individual tax components may be:

| • | Levied by different tax authorities |

| • | Payable to tax authorities on different dates |

| • | Subject to rate changes at different times |

| • | Applicable to different customers |

| • | Effective only for certain categories of goods or services |

Basic instructions for creating multi-component custom tax codes are contained in another Guide6. Those instructions are adequate for simple situations where all components:

| • | Apply simultaneously to goods or services |

| • | Are payable to the same authority at the same time |

| • | Are not expected to change |

An example

This Guide uses a custom tax code with four components as an example. The overall tax code is named Sales Tax 8.845%. Components are levied by the state, a special transit district, the county, and the city. Percentage tax rates are as shown:

In the simple situation outlined above, all components can be assigned to the default Tax payable account, which MYBOS creates automatically when the first tax code is entered. On a sales invoice with a line item to which this tax code applies, the applicable tax code is selected:

![]()

Screen Shot 2016-09-24 at 12.55.46 PM.png1241x75 19.5 KB

The resulting sales invoice lists the individual tax component amounts rather than the overall tax code:

Screen Shot 2016-09-24 at 1.04.55 PM.png744x258 19.7 KB

Assuming no other taxable transactions have been recorded yet, the Summary shows all taxes payable in a single account:

![]()

The various tax reports in the Reports tab also group all components together. For example, the Tax Summary report includes just one line:

If it is necessary to determine how much of each component was collected, a calculation must be made outside MYBOS. For example, the state component of tax collected in the report above is the ratio of that component to the total tax rate multiplied by the tax collected, so:

2.90 / 8.845 x 8.85 = 2.90

In this single-transaction example, that result matches the amount charged on the only sales invoice. (When more taxable transactions are recorded, the prorated portion is not so obvious, of course.) But this is cumbersome. MYBOS can streamline the process.

Establishing separate tax payable accounts

To keep track of individual tax components when they are payable to different authorities or on different schedules, create separate tax payable accounts for each. In the Settings tab, select Chart of Accounts:

=>

=>

On the Balance Sheet side, click New Account:

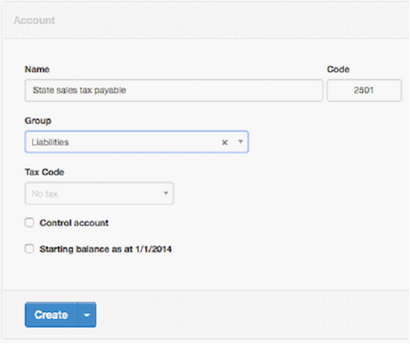

Enter a name for a tax payable account for the first tax component. In this example, account codes are used to order accounts. The default Tax payable account has the code 2500, so the state sales tax component is given 2501. Place the account in the Liabilities group (or a subgroup under that). Leave the Tax Code field and Control account checkbox blank. Leave Starting balance blank unless you had a carryover amount at your Start Date. Click Create to finish.

Repeat the process for the other tax components. Then return to Settings => Tax Codes and edit the tax code by assigning each component to its matching tax payable account:

Now, the Summary shows a breakdown of how much tax is owed to each authority:

Although the default Tax Payable account remains empty, it cannot be deleted. It is a control account that was created when the first tax code was defined, but is now functioning as a pass-through account. Payments to various tax authorities can now be posted to their appropriate accounts, eliminating the need to calculate prorated shares of the overall tax code.

At the present time, tax reports in MYBOS cannot break out individual components.

Handling different taxable situations

For situations where all tax components do not apply, create new tax codes to match. In the example, goods and services delivered outside the city are exempt from the city sales tax component, but still subject to the other three. And food sales are exempt by law from the transit sales tax. So two new tax codes are created in the same manner as the first:

| • | City-exempt sales tax 4.985% |

| • | Transit-exempt sales tax 7.745% |

Account assignments are made to the same four tax payable accounts, as appropriate. Codes would also be created for any other feasible combinations of customer, location, and applicability. Every code is, in effect, a subset of the basic, four-component code originally created. Sales transactions can be designated for proper tax treatment based on identity or location of the customer, type of goods, etc. If necessary, tax codes can be selected on a line item basis within either a sales invoice or cash receipt.

After the new tax codes are in place, a second sales invoice for the same services to a customer outside the city is summarized on a new line on the Tax Summary, reflecting the lower tax rate:

But the various components are posted to the same tax payable accounts as before:

Changing component tax rates

When a component of a tax code changes, a completely new tax code must be created.

CAUTION: Never edit components of a tax code that has already been used for any transaction. All previous transactions using that code will be retroactively modified.

Good practice is to change the name of the obsolete tax code. Reusing the original name for the updated code can help users remember which one to select. Document changes in business files to support future questions or audits. Potentially useful name changes include:

| • | Adding a date indication, such as Pre-2017 |

| • | Inserting an obvious prefix, such as XXXX |

| • | Substituting a deterrent, such as Do Not Use |

Modified tax codes will remain available in MYBOS in case they can be adopted again.

Returning to the example, assume the state sales tax component increases to 3.5% mid-year. A new tax code is created and the obsolete one renamed. Subsequently, a third sales invoice for identical services to a customer within the city is issued. The resulting Tax Summary shows all three rates used during the accounting period:

Paying individual tax authorities

Rather than paying off all or a portion of a single Tax payable account, payments can be made to tax authorities for a single component, posting the Spend Money transaction to the appropriate component's tax payable account. Assume, for example, the transit tax is remitted. Only the relevant account need be zeroed out. The Balance Sheet shows the amounts remaining to be paid to other tax authorities: